A recent "Wall Street Journal" article summarized current funding availability for biopharma with "The gravy days are over." One key issue identified: "Venture capitalists invested a total of $3.92 billion last year in biotechs of all stages, well below the $6.17 billion peak in 2007, according to VentureSource. And shares in biotechs that went public last year averaged 29% less than their expected midpoint offering price, according to investment bank Needham & Co. Some venture capitalists have stopped funding new biotech altogether."

A clear, and potentially highly ominous, warning about the future challenges in VC funding for biopharma comes from the National Venture Capital Association's October 2011 survey results; the report states:

"A 2011 study found that U.S. venture capitalists have been and will continue to:

- Decrease their investment in biotechnology and medical device start-ups

- Reduce their concentration in critical therapeutic areas, and

- Shift focus away from the United States towards Europe and Asia

FDA regulatory challenges were identified as having the highest impact on these investment decisions."

To address the acknowledged issues with FDA shortcomings, recent legislative efforts have been implemented to improve FDA processes and reduce review and approval time; they include:

Next 3 Years - Expected Change in Investments in Healthcare Sectors,

% of Respondents

As the survey data indicates, investors are placing their bets on lower up-front investments with a lower risk profile (services, consumer health, and IT) than biopharma and devices.

Number of Deals

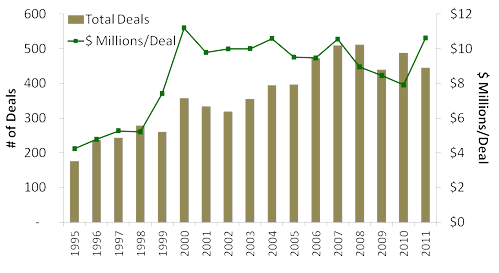

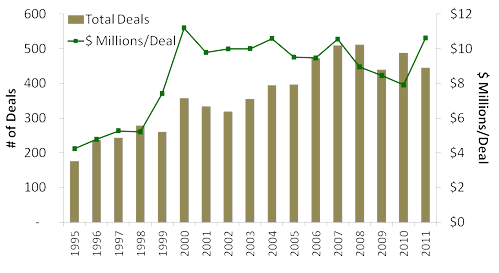

Next, charting the most recent MoneyTree™ "Report for Investments by Industry, Q1 1995 - Q4 2011", report shows that the number of total biotechnology deals has a relatively negative trend for the last five years, with fewer deals reported in 2011 than in 2010. The average deal value for 2011 was 22% higher at $10.6 million vs. $7.9 seen in 2010.

Total Number of Deals and Investment (US$ millions)/Deal (1995 - 2005)

However, as many of these deals were with already established ventures (representing a lower risk population for investors), these data suggest fewer new drugs and technologies will have access to critical funding, reducing the likelihood of their development and eventual commercialization.

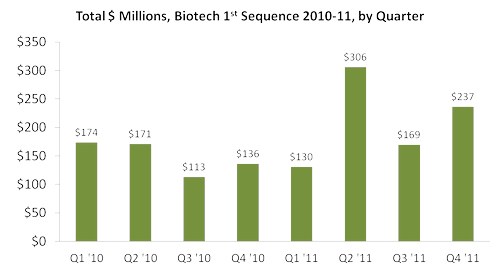

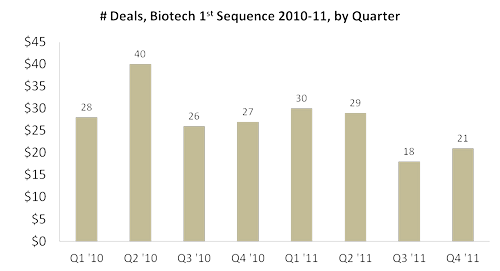

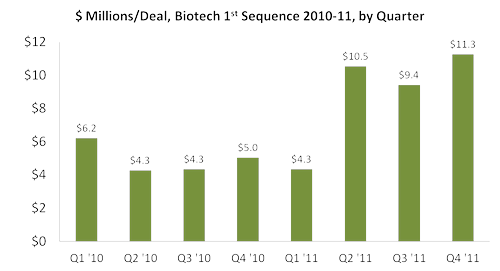

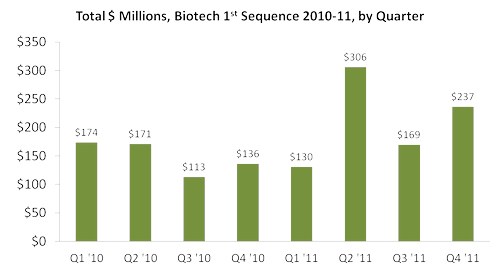

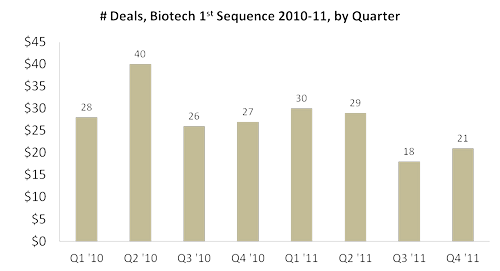

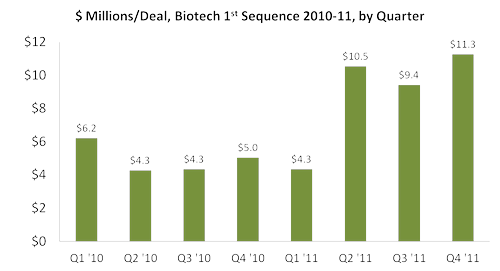

To dive a bit deeper, let's look at only 1st-sequence funding for the last two years.

- Total 1st-sequence investment is trending higher in 2011 than in the preceding 2010 quarters, +42% year-on-year:

- Total number of 1st-sequence deals is trending lower in 2011 than in the preceding 2010 quarters, -19% year-on-year:

- Total 1st-sequence investment per deal is trending higher in 2011 than in the preceding 2010 quarters, +79% year-on-year, an average of $8.9 million in ’11 vs. $5.0 million in ‘10

From the data, 1st-sequence funding per deal is higher in 2011 but fewer deals were executed. It is assumed that investors were being selective and funneling money to those deals with lower risk, which typically would be projects with more robust proof-of-concept data. This assumption is supported by a January 20, 2012 article in Genetic Engineering & Biotechnology News.

Key points pulled from the article:

- “’The increase in deal sizes and total investment activity seen in 2011,’ Jonathan Leff, a partner and managing director with Warburg Pincus, said,‘came mostly from companies formed 10 to 15 ago with VC money, either during the 1990s tech boom or soon after. Of the 30 drugs approved by FDA in 2011, half were labeled priority drugs, of which 13 originated with venture-backed biopharmas.’”

- “’As these companies advance, fewer companies will take their place’, Leff added. ‘Unless this trend is reversed and unless the capital begins coming back into new formation and supporting new innovative products and technologies, this will result in a real decline in the number of new innovative drugs and medical devices that will come to market in the years and decades ahead,’ Leff declared.”

- “VCs are finding that the cost, time, and uncertainty involved in developing innovative drugs and medical devices have all escalated to the point where increasingly, the economic math just does not work.”

- “’Several VC firms have reduced or eliminated biotech investments in recent years. That could change,’ Leff said, ‘if Congress approves several regulatory reforms under review as part of the fifth authorization of the Prescription Drug User Fee Act (PDUFA V) for the five federal fiscal years starting October 1.’”

- “The reforms, designed to speed up FDA reviews, commit the agency to three meetings with drug developers on an application as well as to reviewing and acting on 90% of standard NME, NDA, and BLA submissions within 10 months to 12 months from the date of filing, and on 90% of priority NME, NDA, and BLA submissions within six months, or eight months from date of filing”

- “’There is reason for optimism that the situation is poised to at least begin improving,’ Leff said, 'any impact on VC investment from PDUFA V regulatory reform ‘will certainly take time’, as much as a decade or more given the typical drug development timeframe, and will depend on how much any changes add predictability and reduce the cost and time of FDA reviews.”

Conclusion

It appears that VCs are derisking their investments by choosing to invest in later-stage and lower risk programs but are increasing the amount invested. Though this seems sensible for the VCs, this movement has an obvious chilling effect on new product development and innovation in the biopharma and device sectors as fewer early/start-ups will be funded than in the past unless there is a clear invest now signal in the opportunity's profile. Is this investment scheme a positive or negative evolutionary step? It remains to be seen as to what the downstream effects this strategy will produce but the investment hurdles are higher than in years past for certain.

Contact Partners in BioPharma Consulting to see where we can help you with developing the optimal product profile, development program, strategies, or presentations to investors. We can manage a project from beginning to end, provide contracted support, or suggest talented experts from our alliance partners to help you achieve your goals. Click here for an outline of services that can be designed to meet your needs.

The following are links that provide additional background and insights on the topics discussed in this article. We hope you find them useful!

The following are links that provide additional background and insights on the topics discussed in this article. We hope you find them useful!

The following are links that provide additional background and insights on the topics discussed in this article. We hope you find them useful!

The following are links that provide additional background and insights on the topics discussed in this article. We hope you find them useful!